Suppose I Can't Stay In My Home Until The Fixings Are Completed?

Having quotes from different certified professionals provides take advantage of when working out with your insurer and makes certain that fixing prices are properly shown. Before filing a home insurance coverage claim, review your policy, document all damages, collect records of beneficial products, and make temporary repair work to reduce more damages. The information given on this website has been established by Policygenius for basic informative and academic purposes.Just how to get the most from a home insurance case?

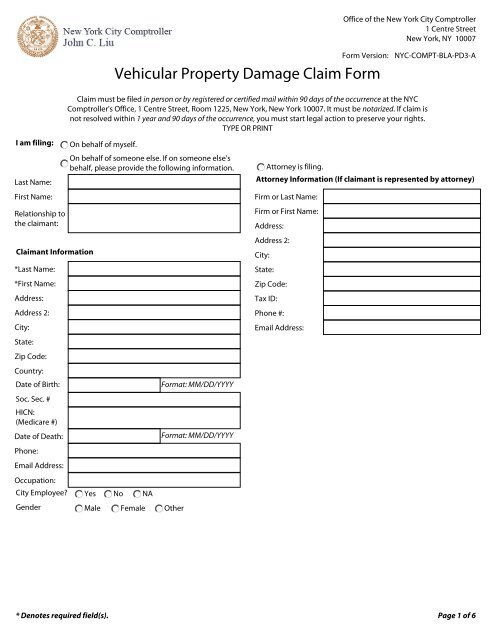

insurance that may cover the case. Place, day, and time of accident.Name, https://troykrrf994.iamarrows.com/storm-typhoon-damage-claims address, contact number, and insurance plan number for all involved in the accident.Weather conditions.Photo (s) of the damaged vehicle(s) Duplicates of the police and/or mishap reports, if appropriate. Below's what you'll commonly require: Personal details: This includes your complete name, date of birth, and get in touch with information. You might likewise need to supply the Social Safety and security numbers for any person living inthe home covered bythe plan. Residential property information: Insurance policy companies will want to know about the residential property itself.

Best Home Insurance Provider Of 2024

Both sides desire a reliable resolution, and if someone is dropping the ball in their workplace, they'll want to know so they can resolve it. After the adjuster's check out, stay in touch with your insurance provider. Nicely however securely inquire about the development of your claim to maintain things moving smoothly. Immediately complete these types as soon as you receive them, and guarantee you return them to the insurer within the defined amount of time. These estimates will certainly provide you a precise concept of the repair service costs, but remember that prices can be impacted by accessibility. Take immediate steps, within the bounds of safety, to prevent added damages to your residential or commercial property. Examples include covering a broken window to avoid rainfall from getting in or cleaning up water from a ruptured pipe. When filing your home owners declare, your insurance company will ask for your name, property address, policy number and the day that the damages or injury happened. The very first step in documenting residential or commercial property damage is to conduct a complete analysis of your home and surrounding residential property. This procedure can be mentally challenging, particularly if your home has received considerable damage.- If that does not function, you can submit an issue with your state's department of insurance.Try to envision the materials of every room and then create a summary of what existed.The possibility of a higher costs rises if you make numerous cases.If your claim is covered, your insurance provider might pay to fix or replace your damaged building.In the majority of states, a choice about whether your insurance claim is accepted or rejected have to be made within a minimal timeframe.If you have lost your checkbook or credit cards, notify the bank or credit card firm as well.